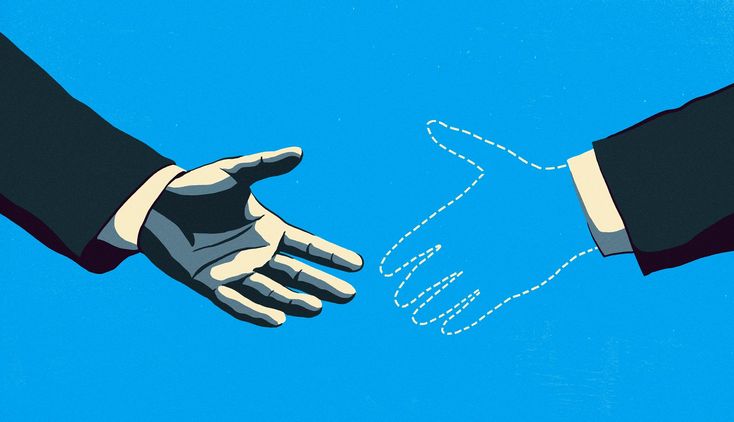

At the peak of the decentralized finance (DeFi) gold rush, AetherPay positioned itself as the bridge between traditional banking and the blockchain revolution. Slick branding, animated explainer videos, and a promise to “democratize digital payments” drew in over $120 million in seed and Series A funding within just nine months. Venture capitalists, dazzled by the founder’s crypto credentials and the platform’s futuristic UX, scrambled to get a piece of the next Stripe-meets-Solana.

By early 2025, the buzz was deafening—and suspiciously empty.

Users started complaining about frozen transactions, disappearing balances, and a customer service team that replied with AI-generated emails—or didn’t reply at all. Then came the bombshell: AetherPay’s backend wasn’t connected to any functional blockchain. It was a closed-loop simulation—just a demo interface masked as live tech.

When security researchers finally got access to the code, they found hard-coded transaction IDs, fabricated ledger histories, and an API that returned canned success messages regardless of input. The "decentralized" wallet was just a front.

Meanwhile, the founder, Milo Hart, vanished. His LinkedIn went dark, his Twitter deleted, and his last public sighting was a private jet boarding at SFO. By the time federal investigators caught wind of the scam, the AetherPay website was scrubbed, Discord servers deleted, and most of the funds had been siphoned into privacy coins and routed through laundering protocols across multiple chains.

With at least 27 venture firms and thousands of early users caught in the crossfire, AetherPay’s implosion is now a case study in FOMO-fueled investing. In an era where sleek design and vague blockchain lingo are enough to secure millions, it’s a brutal reminder: not all tech needs to work to get funded—it just needs to look like it does.